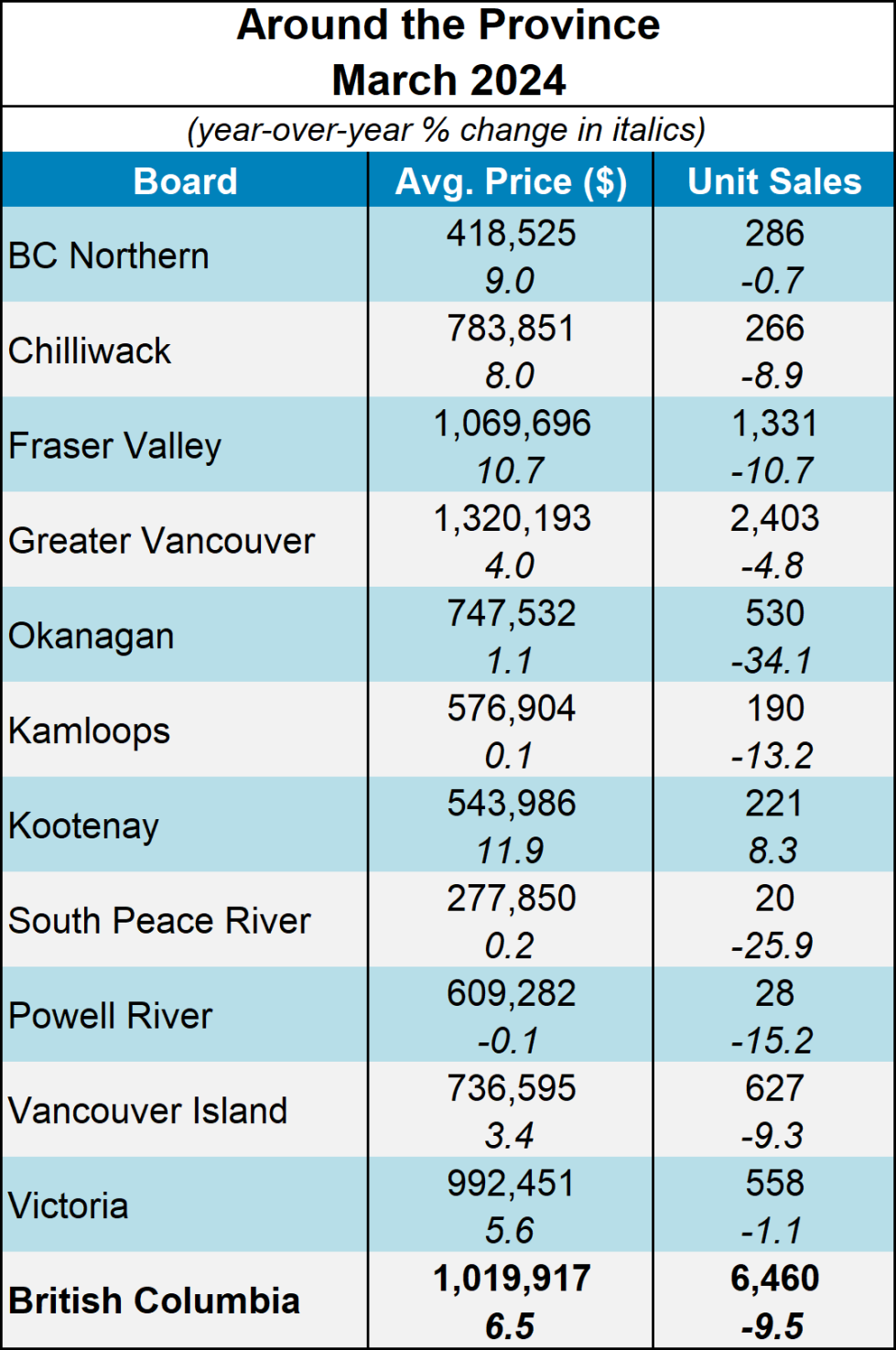

In March 2024, British Columbia witnessed a notable slowdown in its housing market, marked by a 9.5% year-over-year decline in home sales, as reported by the BC Real Estate Association (BCREA).

Despite this, the average home price in BC rose by 6.5% compared to March 2023, reaching $1.02 million. This trend indicates a cautious approach by buyers, potentially waiting for policy shifts from the Bank of Canada (BoC) before making significant investment moves.

BC Home Sales in March

BCREA’s data for March 2024 revealed a total of 6,460 residential home sales through the Multiple Listing Service (MLS), reflecting the market’s subdued activity during the period. However, while sales figures dipped, the average price of homes in BC showed resilience, experiencing a notable increase from the previous year.

First-Quarter Performance Overview

Despite the March slowdown, BC’s housing market displayed positive performance metrics for the first quarter of 2024. Sales dollar volume surged by 13% year-to-date, reaching $15.8 billion, with residential unit sales witnessing a 6.4% uptick to 15,938 units. The average MLS residential price also saw a significant rise of 6.5% to $995,149 during the first three months of the year.

Buyer Sentiment and Bank of Canada’s Influence

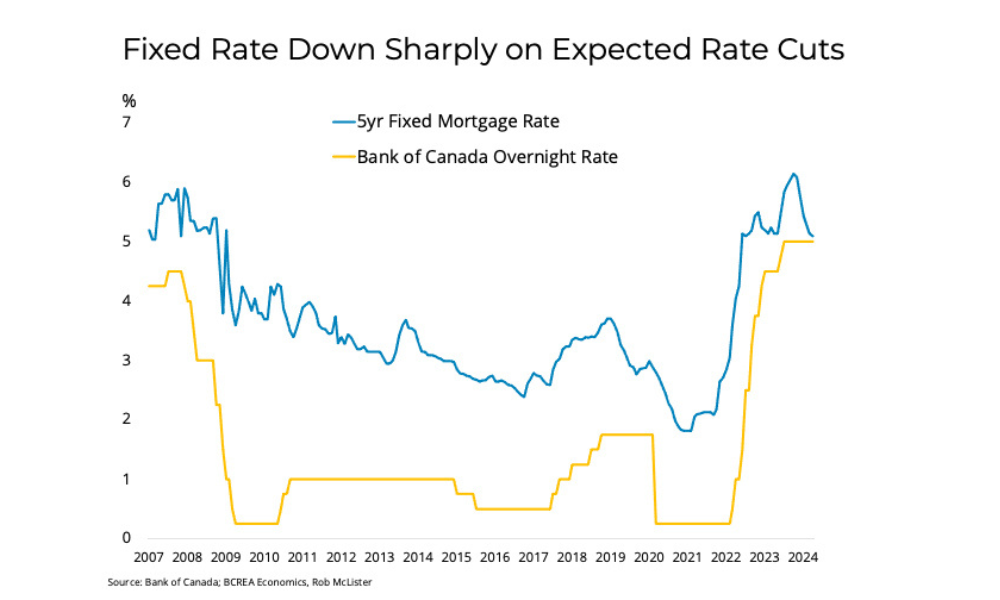

BCREA’s chief economist, Brendon Ogmundson, suggested that potential buyers are adopting a cautious stance, possibly awaiting interest rate adjustments by the central bank before engaging more actively in the market. Despite notable decreases in fixed mortgage rates, buyers seem inclined to await the BoC’s policy decisions regarding interest rates.

Forecasts and Expectations

BCREA’s separate report forecasts a potential initiation of rate cuts by the BoC as early as April, anticipating a response to the market conditions and economic indicators. The association’s analysis indicates strong probabilities of rate adjustments, with financial markets signaling a potential 25 basis points cut during the June meeting, and an estimated 100 basis points cut by the end of December.

BC’s housing market in March 2024 experienced a slowdown in home sales, potentially influenced by buyers’ anticipation of rate cuts by the Bank of Canada. Despite this, the overall first-quarter performance remained positive, with notable increases in sales volume and residential prices. The market’s trajectory in the coming months will likely be shaped by policy shifts and economic factors, emphasizing the importance of monitoring the BoC’s decisions for both buyers and sellers in British Columbia’s real estate landscape.