Market Intelligence, Peerage Partners, Real Estate News

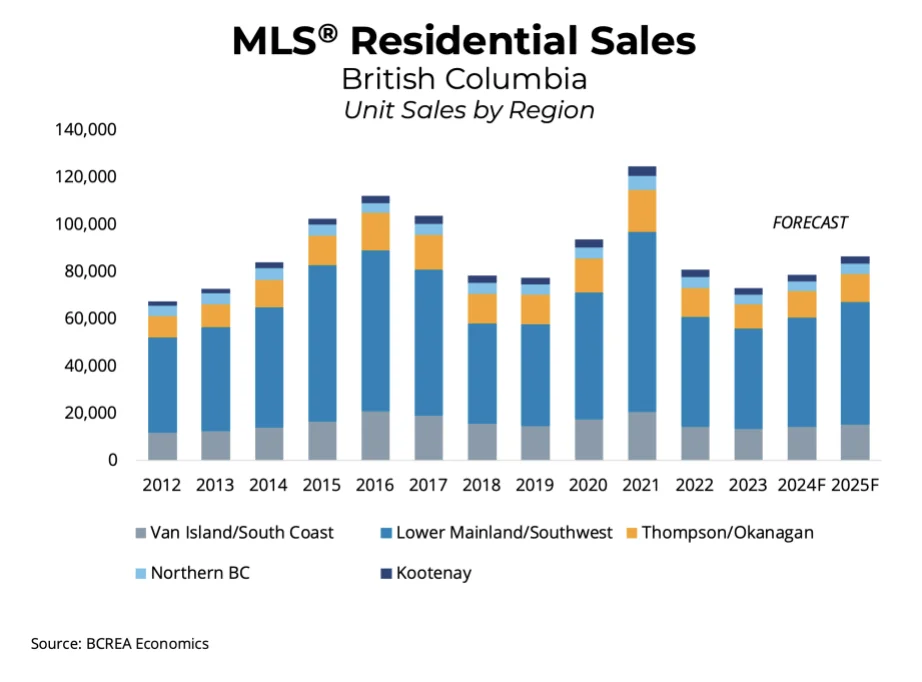

The release of the 2024 First Quarter Housing Forecast Update by the British Columbia Real Estate Association (BCREA) offers the latest insights into the BC housing market.

After a sluggish 2023 marked by elevated mortgage rates, the province is gearing up for a resurgence in the real estate sector in 2024, setting the stage for a robust 2025.

2023 Recap: Challenges and Slowdown

In 2023, British Columbia experienced its slowest housing activity since 2013, with a total of 73,000 home sales. Elevated mortgage rates deterred both buyers and sellers, presenting challenges to the market. However, there is anticipation that the housing market will receive a fresh boost, thanks to a recent shift in the mortgage landscape characterized by declining rates and the potential for rate cuts by the Bank of Canada.

Projections for 2024 and Beyond

The BCREA’s latest update forecasts a promising 7.8 percent increase in MLS residential sales, reaching 78,775 units in 2024. Looking ahead to 2025, the projection is even more optimistic, with MLS residential sales expected to rise further to 86,475 units.

Brendon Ogmundson, the association’s chief economist, emphasizes the positive shift: “As we navigate through 2024, we expect a delicate balance between rising sales and normalizing inventories, leading to a relatively quiet year for prices.”

Bank of Canada’s Role in Market Recovery

The update sheds light on the pivotal role of the Bank of Canada in stimulating the housing market.

Expecting a decrease in inflation and a slowdown in economic growth, the BCREA predicts that the Bank of Canada will lower the policy rate to 4 percent by year-end.

This adjustment is actively shaping fixed mortgage rates, causing some to dip below 5.5 percent and actively enhancing the affordability of homeownership.

Balancing Act: Sales, Inventory, and Prices

BC real estate faces a delicate balancing act as the looming prospect of increased sales poses the potential risk of rapid price appreciation. However, the latest update puts forward a viable solution.

The anticipation of higher mortgage payments is set to actively stimulate a surge in new listings, actively establishing a more balanced market and ultimately playing a crucial role in stabilizing prices.

Transitioning seamlessly into the promising projections presented in the BCREA’s 2024 First Quarter Housing Forecast Update, the BC real estate market emerges as a resilient player, ready for revival.

The anticipated decline in mortgage rates and the potential for rate cuts by the Bank of Canada lay the groundwork for increased sales and a steadfast stabilization of housing prices.

As the market dynamics evolve, consequently, the synergy between rising sales and stabilized inventories becomes the focal point, actively guiding British Columbia’s real estate landscape toward a year of growth and stability.

Market Intelligence, Peerage Partners, Real Estate News