Vancouver Real Estate Market: Signs of Stabilization Amid Rising Borrowing Costs

The Vancouver real estate market has long been a hot topic due to its skyrocketing home prices. Many prospective buyers and investors have wondered about the sustainability of this trend. Recent developments, however, suggest that higher borrowing costs may lead to a stabilization of home prices. Let’s explore the factors contributing to this potential stabilization and what it means for buyers and sellers in the region.

Understanding the Vancouver Real Estate Landscape

To grasp the current situation, it’s essential to understand Vancouver’s unique real estate market. Often ranked as one of the world’s most desirable cities, Vancouver has experienced substantial population growth, limited land availability, and high demand for housing from both local residents and international investors.

Factors Influencing the Stabilization of Home Prices

Rising Interest Rates

One primary factor contributing to potential price stabilization is the increase in borrowing costs due to rising interest rates. Historically, low mortgage rates have fueled real estate demand. As rates climb, home affordability decreases, making it harder for buyers to qualify for large mortgages. This slowdown in demand can eventually help stabilize prices.

Government Policies

The Canadian government has implemented policies to curb speculative investments and foreign buying in Vancouver. Measures like the foreign buyers’ tax and stricter mortgage stress tests have created a more balanced market. These policies reduce demand from outside investors and prevent excessive price inflation.

Supply and Demand Dynamics

Vancouver often experiences a supply-demand imbalance, with demand outpacing available housing inventory. However, as interest rates rise and affordability becomes a concern, the gap between supply and demand may narrow. This could exert downward pressure on prices, helping them stabilize.

Economic Factors

The overall economic health of Vancouver influences the real estate market’s performance. Employment rates, income growth, and migration patterns affect housing demand and home prices. Monitoring these economic indicators can provide valuable insights into the market’s direction.

Current Market Data

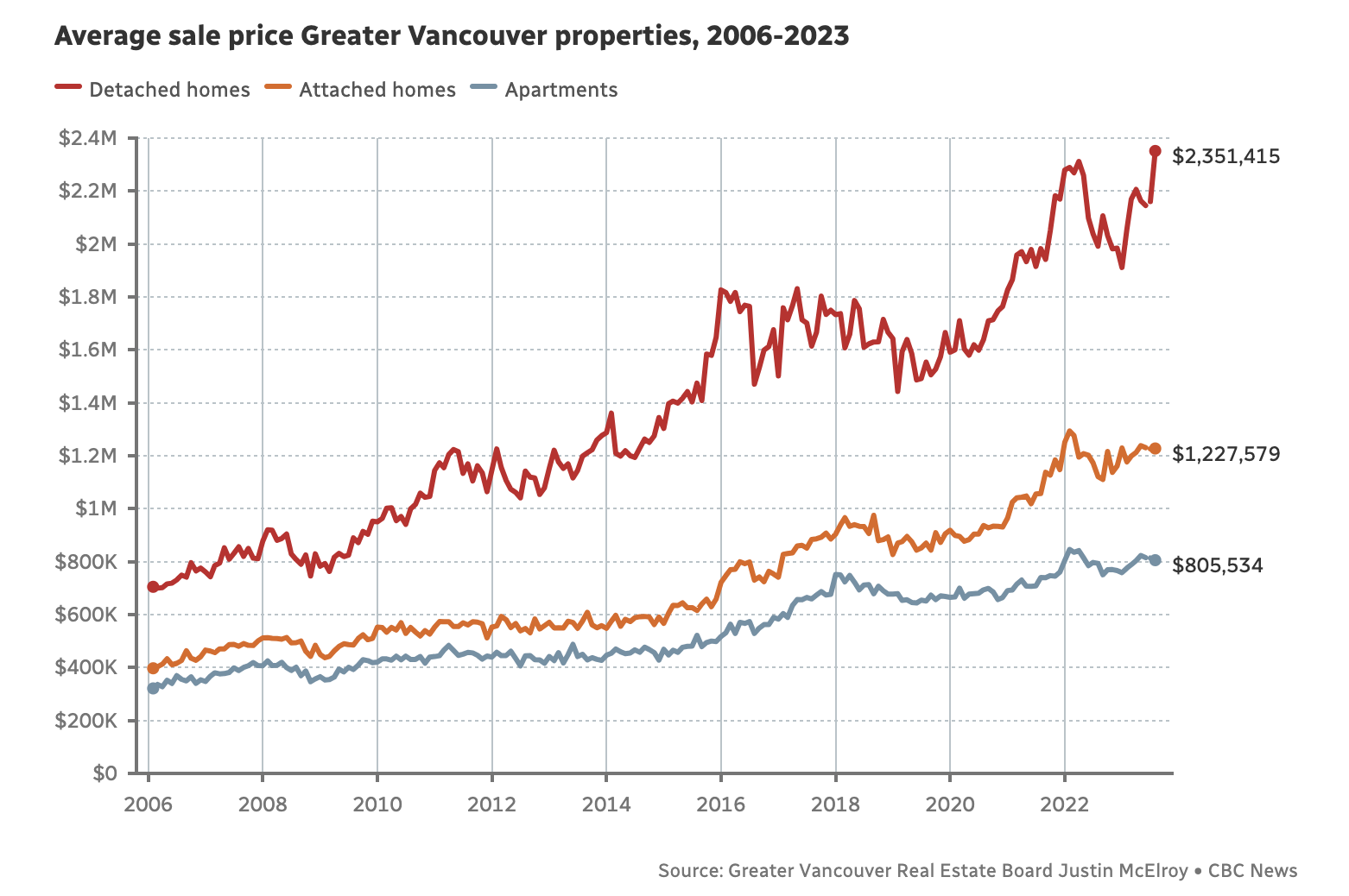

Recent data from the Real Estate Board of Greater Vancouver (REBGV) highlight evolving market conditions. In August 2023, the composite benchmark price for the Vancouver area reached $1,208,400, marking a 2.5% increase from August 2022. This shows a continued, albeit slower, upward trend in home prices.

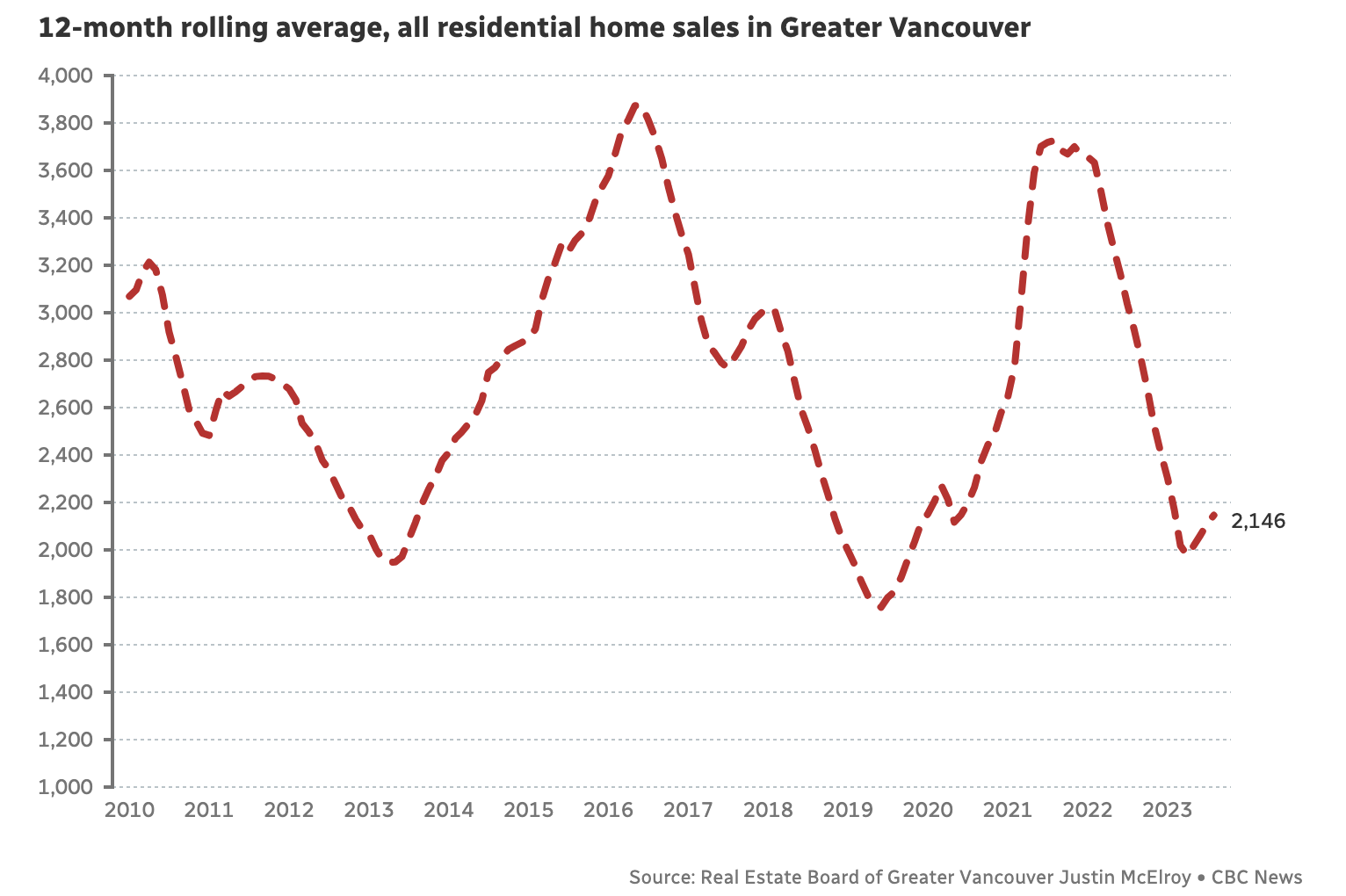

August sales totaled 2,296, representing a 13.8% decrease from the 10-year seasonal average. However, compared to the same period a year earlier, August sales jumped more than 21%. This data demonstrates the market’s resilience and signals a shift toward more moderate growth.

There were 3,943 new listings in August, an 18% increase from a year earlier. Yet, new listings remained 5.3% below the 10-year seasonal average, indicating ongoing supply challenges.

Expert Insights

Andrew Lis, the REBGV’s economics and data analytics director, commented on the market’s recent performance. He noted, “It’s a bit of a tortoise and hare story this year, with sales starting the year slowly while prices increased due to low inventory levels. As fall approaches, sales have caught up with the price gains, but both metrics are now slowing to a pace more in line with historical seasonal patterns and with what one might expect given that borrowing costs are where they are.”

In conclusion, the Vancouver real estate market shows signs of stabilizing due to higher borrowing costs, government policies, and evolving supply-demand dynamics. This potential stabilization offers a more balanced market for buyers and sellers, aligning with historical seasonal patterns.

The Vancouver real estate market’s journey towards stabilization amid higher borrowing costs signifies a shift in the dynamics that have driven prices upward for years. While it’s challenging to predict exactly how the market will evolve, understanding the factors and staying informed can help buyers and sellers make informed decisions in this evolving landscape. Consulting with a local real estate expert is advisable to navigate the Vancouver market effectively. The areas and municipalities covered by the REBGV are Bowen Island, Burnaby, Coquitlam, Maple Ridge, New Westminster, North Vancouver, Pitt Meadows, Port Coquitlam, Port Moody, Richmond, South Delta, Squamish, the Sunshine Coast, Vancouver, West Vancouver, and Whistler.

With files from The Real Estate Board of Greater Vancouver and CBC

Bringing People Home, Home Buying, Real Estate News

Ksana Connects Residents to Nature Port Moody’s Urban Setting

Read moreHome Buying, Market Intelligence, Your Next Home