Market Intelligence, Peerage Partners, Real Estate News

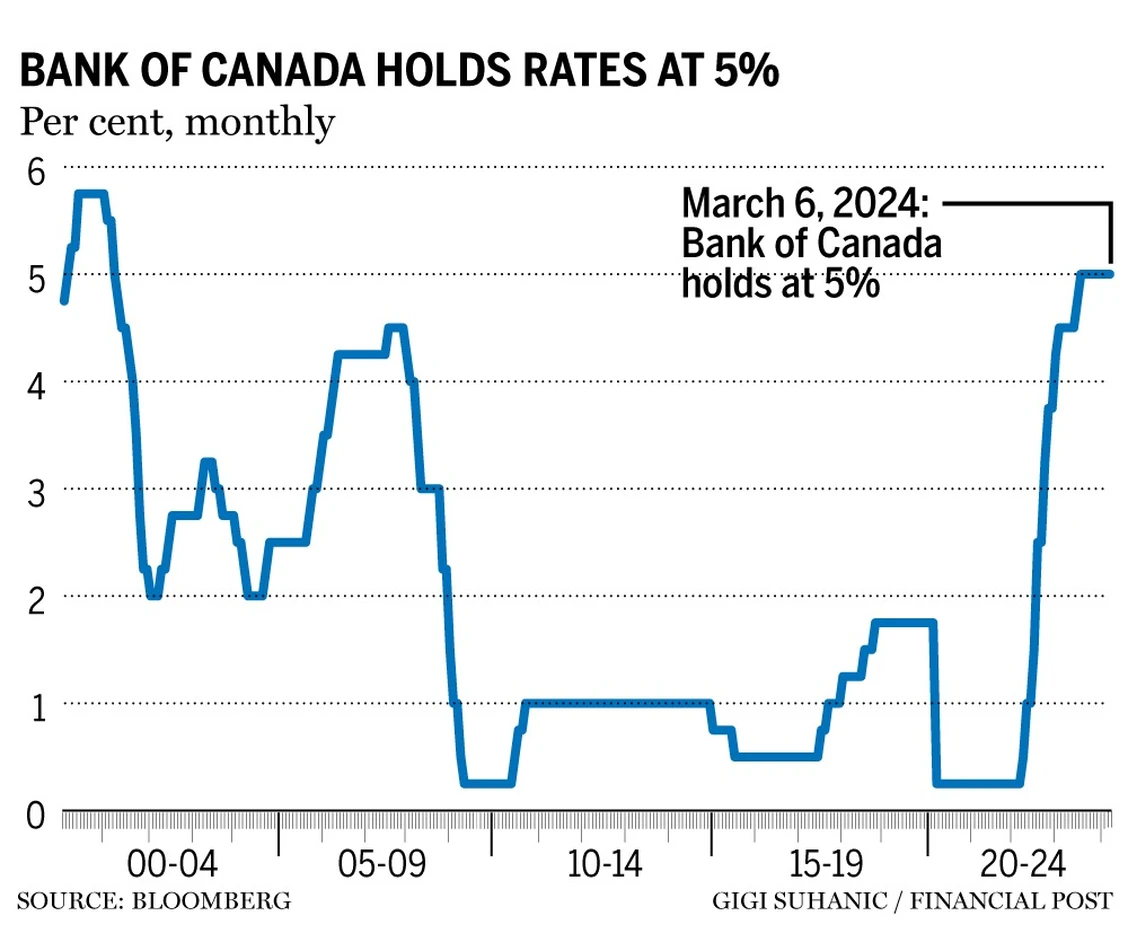

The Bank of Canada has decided to keep its interest rate at a solid five percent. Governor Tiff Macklem articulated this move, emphasizing patience in the economic landscape and asserting that the timing for rate reductions isn’t right yet. This cautious stance, expected by many economists, aims to balance curbing inflation with nurturing economic growth.

Home Buyers Gain Predictability

This decision brings predictability for potential home buyers. With interest rates steady, future borrowing costs become clearer. Jamie Squires, President of Fifth Avenue Real Estate Marketing, views this as a market stabilizer. She remarks, “Predictable interest rates foster buyer confidence and make homes more affordable.” This perspective underscores a broader expectation of continued demand in the real estate sector, possibly signalling a robust period for property transactions.

Expert Opinions and Future Outlook

Economists speculate that there is potential for easing of rates by mid-year. Nevertheless, Governor Macklem urges caution. He tempers expectations for rapid rate reductions, saying, “Rate cuts won’t mirror the swift pace of past increases.” This conservative stance leaves room for optimism. Economists like James Orlando from Toronto-Dominion Bank advocate for patience, suggesting that waiting could lead to beneficial rate adjustments.

What Does This Mean for Prospective Buyers?

For those watching the housing market, the message is to stay observant and patient. The current stability in interest rates suggests that now is a time for planning. Therefore, staying abreast of economic and rate trends will be crucial for making informed decisions. As the Bank of Canada navigates economic uncertainties, its actions today will lay the groundwork for potentially more favourable borrowing conditions.

Navigating Forward: The Path to Homeownership

The Bank of Canada’s implementation of a steady interest rate shows its commitment to economic stability. Balancing controlled inflation with the dynamics of the housing market provides predictability in uncertain times. For potential home buyers, this period represents an opportunity to assess their positions with an eye towards future market movements. Moving forward, understanding the nuanced impacts of the Bank’s interest rate decisions will be paramount for those strategizing toward homeownership.

Source: The Financial Post

Source: CBC

Source: Bank of Canada

Market Intelligence, Peerage Partners, Real Estate News